Panic in Basel: Central banks are preparing for the crash

MAYBE this video is Deep-fake

Yanis Varoufakis reports on a secret crisis meeting in Basel, at which Western central bankers openly showed panic.

A senior Fed representative there literally said that we should stop pretending that the situation is "controllable". The demand for US government bonds is collapsing, repo markets are failing.

Several major foreign creditors wanted to exit US Treasuries, which is why central banks are now secretly selling them via offshore channels to avoid triggering an open crash. Internally, capital controls, bank holidays, and $3–5 trillion in pension losses are already being anticipated.

A Nordic central banker told Varoufakis: "There is no scenario that ends well."

The time horizon: 12–18 months, in the worst case weeks. For example, with a new BRICS currency or a geopolitical shock.

According to Varoufakis, those who are supposed to prevent the collapse have admitted one thing: They have no plan.

The video above is attributed to Yanis Varoufakis, a prominent public intellectual who has served the Greek government as Minister of Finance and in a number of other capacities. The video highlights the thinker’s reflection on an alleged secret meeting said to have taken place at the Bank of International Settlements in Basel Switzerland. Varoufakis begins by proclaiming his video report violates many confidentiality agreements.

The presenter makes the case that he has opted to violate the privacy rules because the public has a right to know. He wants to make us aware of how a number of elite technocrats in the running of global finance, displayed various versions of terrified panic. Varoufakis cites case after case emphasizing that the delegates declared they have no remedy for the economic debacle already engulfing the world.

At best, says Varoufakis, the technocrats put in charge of overseeing the institutions of global finance are contemplating an international version of palliative care to put to rest “a global economic order built on assumptions that are no longer true.” So what now is true?

The bankrupt impoverishment of a worldwide system of gargantuan debt financing is becoming too obvious to hide from the public. Varoufakis predicts that the public panic will mushroom when pension plans begin to “crater” in the ways he predicts.

The video presents a synthetic account of how so many key interactions in global financial relations are breaking down, with much worse coming at us in plain sight. The falling value of the US dollar is close to the heart of the chaos. As the dominant economic power to emerge from the world wars of the twentieth century, the USA is facing the narrowing confines of the failing American Dream. Some are imagining US domination will give way to the global rise of “multilateral economic leadership.” Can such a transition happen peacefully?

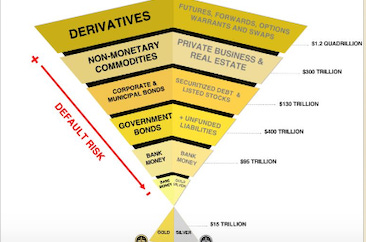

Silver, Gold, and Derivatives

The rising demand and pricing of gold and silver represents the opposite extreme of the steady and accelerating loss of the purchasing power of American dollars and other varieties of fiat currency. The honesty of this gold and silver trade, however, has long been blemished by so-called “paper” transactions. These transactions encompass various kinds of contracts that preclude the buyer taking possession of the actual mineral.

Since the early 1970s the system has been manipulated to keep gold and silver prices deflated compared to the value of paper money. Peter Munk’s Barrick Gold Company in Canada played a role in keeping gold prices deflated compared with US currency. Former US President George H. W. Bush worked closely with Munk to achieve this covert objective.

Institutions involved in the paper gold and silver trade are prone to use the imagery of minerals to pull off variations of the factional reserve banking scams where bankers buy and sell the same mineral object, say one or two hundred times. The lucrative scam remains viable as long as customers are content to keep their transactions in the realm of fiat currency rather than demanding to take possession of the physical mineral. Those that hold gold and silver in their own possession theoretically have no counter parties to deal with.

The public is becoming increasingly aware of the colossal failures entailed in the frauds permeating the fiat money system as often characterized by unstable chains of debt financing. The result is that people want to take direct ownership of gold and silver, the minerals that are returning to their historical role as the most durable and broadly acceptable stores of value in a political economy increasingly dominated by spin, hype and razzle dazzle.

Once society was lured into this dead end journey, the conditions of our current financial disaster were brought to fruition. In our current predicament most of the economy is composed of a vast variety of derivatives. Derivatives are derived from sources of real wealth, silver and gold pre-eminent among them.

Under current circumstances, fiat currency including paper money is becoming the number one category of derivative. The financial debacle of 2008-09 was triggered by new forms of deregulation allowing from the production of new forms of financial derivatives whose overabundance led to the government’s massive bailouts of banks and insurance companies such as AIG. As the crisis in overnight REPO markets on Wall Street indicates, the hollowness of deregulated derivatives is integral to the global complex of financial breakdowns already well underway.

Big changes to the global silver market are illustrative of many larger patterns of change underway. As exemplified by the important global role of the “pound sterling” in the rise of the British Empire, silver has an oversized role in the history of money. As things are unfolding now, silver should no longer be mistaken as the poor cousin of gold.

Silver has acquired massive new industrial value in many manufacturing and research processes. Silver is the world’s best conductor of both heat and electricity. It is an essential ingredient in electronic hardware including in both military and civilian applications. It is a primary ingredient in the manufacturing of solar panels and electric vehicles. It applications to medicine have a history that goes very far back.

Suddenly silver is jumping into a central role on many levels. On January 1st the government of China, which has had a huge role in silver production and distribution, began strict restrictions on the export of silver. This move has huge implications for the business and for the future of technology.

Meanwhile, the paper bound silver trade centred in New York and London is being bypassed. China is stepping out, asserting pre-eminence in the global silver trade. The government of China is thereby scoring a big win in its systematic efforts to capture global dominance.

AI and the Assault on the Viability of the Internet

Is the Varoufakis video a production of Artificial Intelligence, AI? How many Internet talks try to trick us into seeing as real, what are, in fact, a forgeries? How can we believe anything we see on Internet screens as authentic renditions of reality. What if we entered a hard copy library only to learn that the names of authors are very often fictitious? What a mess that would be! The mess AI is making of the Internet is no less massive!

An AI video can be seen as a digital form of derivative. What is presented on the screen is derived from some unknown person’s view of what the talking head might have said or what he or she wanted the talking head to say.

The plaguing of the Internet with the toxin of unidentified AI presentations is indicative of the contempt in which the public is held by our governors. The flooding of the Internet with familiar faces spouting words that are not theirs, is a bane on public discourse that is totally unacceptable.

As I reflect on the message attributed to Varoufakis I have in mind his account about how everyone at the meeting seemed to have the best interests of the general public in mind. I wonder about that. I wonder about the veracity of the idea that so many public officials are genuinely concerned with the public interest.

Wouldn’t it be more likely that the dilemmas we are facing at this juncture have been caused in some instances by the malevolent actions of those misrepresented as being frustrated guardians of the general wellbeing of the global population

Unfortunately, it appears that is an AI deepfake of Yanis Varoufakis.

https://x.com/donuncutschweiz/status/2006966730803798084

Brilliant framing of the epistemic nightmare here. The irony is that even if teh Basel meeting claims are accurate, deepfakes have already poisoned the well so badly we can't trust the messenger. I've been thinkin alot about how this creates a kind of informational arms race where institutional credibility matters more than ever, yet those same institutions are the ones allegedly panicking behind closed doors.