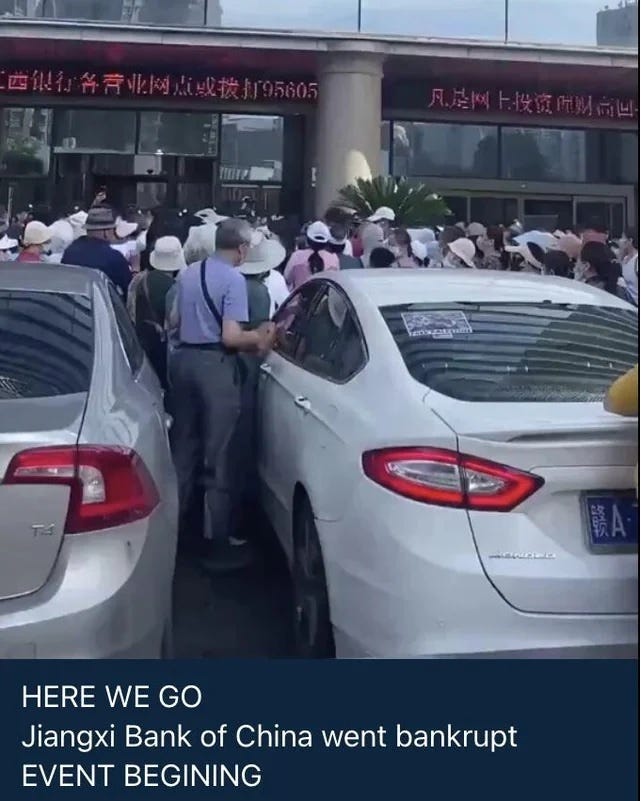

Jiangxi Bank Of China Fails: Depositors Storm Bank

Over the past week, a Banking catastrophe has unfolded inside China, with FORTY (40) Banks Failing and having to be absorbed by other banks. Yesterday, Jiangxi Bank – a GIANT – went under causing Depositors to storm the bank demanding their money.

China’s banking sector is facing a full-scale crisis. In just one week, 40 banks disappeared, absorbed into larger institutions.

Yesterday, Jiangxi Bank of China went under, further escalating the crisis.

China’s smaller banks are struggling with bad loans and exposure to the ongoing property crisis.

Scope of the Problem

Some 3,800 such troubled institutions exist. They have 55 trillion yuan ($7.5 trillion) in assets—13% of the total banking system—and have long been mismanaged, accruing vast amounts of bad loans. Many have lent to real estate developers and local governments, gaining exposure to China’s property crisis. In recent years, some have revealed that 40% of their books are made up of non-performing loans.

Bank of Jiujiang, a mid-tier lender, recently revealed that its profits might fall by 30% due to poorly performing loans. This rare disclosure highlights the severity of the situation. The authorities have been pushing for more transparency, but the true extent of the bad debt problem is still emerging. The four state AMCs created to manage bad debts are now struggling themselves, with one needing a $6.6 billion bailout in 2021.

Disappearing Banks!

China’s main way of dealing with small, feeble banks: making them disappear. Of the 40 institutions that vanished recently, 36 were in the Liaoning province and absorbed into a new lender, called Liaoning Rural Commercial Bank, which was created as a receptacle for bad banks. Since it was set up last September, five other institutions have been established to do similar work, with more expected.

The Root Cause: Property Sector Recession

The root cause? China’s property sector is in a deep recession. Overextended real-estate developers and local governments have defaulted on loans, creating a cascade of financial instability. Property prices have plummeted, and construction projects have stalled, further straining the financial system.

Hidden Bad Debts and Regulatory Crackdown

Adding to the complexity, banks have been using asset-management companies (AMCs) to offload toxic loans, creating a facade of stability. These AMCs buy bad loans but avoid taking on the credit risks, leading to a buildup of hidden bad debts. The National Administration of Financial Regulation (NAFR), a new banking regulator, has been cracking down on these practices, issuing fines and increasing oversight.

What is Coming?

This regulatory vanishing act will probably pick up pace. S&P Global, a rating agency, reckons it will take a decade to complete the project. While fewer bigger banks are easier to regulate, combining dozens of bad banks only creates bigger, badder banks.

The fact remains that the Chinese economy is in an extended and pretend state. Years of credit-fueled growth has finally run its course, and the result will be. lower growth for China and a negative impact on the global economy. Slower growth of the Chinese economy will, in turn, exacerbate their banking problems too.

This will very likely end in massive liquidity injections, stimulation of the economy, and investors flocking to hard assets.

ANALYSIS

This is not only happening in China; It is all over the world. Crises will happen one after another.

This is why more and more individuals and central banks are trying to hold more hard assets. But, those who hoard gold will also have a hard time as Bitcoin is monetizing gold.

My question is: will China be able to contain this by themselves? If so, then nothing to see here. If not, this will spread, worldwide, fast.

40 banks went bankrupt in China

The crisis that started in the real estate sector in China spread to the banks as well. 40 banks in the country declared bankruptcy. When the people flocked to withdraw their money, the security forces protected the banks with tanks.

In China, the collapse in the real estate market is turning into an economic crisis, TRT haber reports.

Banks are also stuck when homebuyers refuse to pay their mortgages for unfinished apartments .

Increasing pressure on 40 banks declared bankruptcy. Depositors, whose deposits have been frozen since April 18, flocked to banks to withdraw their money.

Tanks deployed in front of banks

A clash broke out between security guards and protesters in front of the branch of the People's Bank of China in the city of Zengzhou .

While the police detained many people, tanks were deployed in front of the bank after the brawl.

Chinese authorities took a new step to quell growing anger. It was announced that the depositors whose deposits were frozen in two cities would be reimbursed.

US DECLINE: Massive Bank Crashes, Economic Downturn Accelerates | Prof. Richard Wolff (Part 1)

Part 2

Volkswagen may close Brussels factory as low EV demand hits Audi

BERLIN, July 9 (Reuters) - Volkswagen on Tuesday warned it may close the Brussels site of its luxury brand Audi due to a sharp drop in demand for high-end electric cars that has hit Europe's top carmaker, forcing it to cut its margin target for the current year.

Volkswagen (VOWG_p.DE), opens new tab has not shut down a plant since it closed the Westmoreland site in Pennsylvania in 1988, and the last VW brand chief to threaten closures in Europe stepped down months after doing so, according to a labour source.

Automakers have been hit hard by lower than expected EV demand after investing heavily in capacity and technology development, with Audi warning earlier this year its sales would dip in 2024 as it worked on introducing new models while also cutting costs.

Volkswagen said the costs of finding an alternative use for the Brussels plant or closing it, as well as other unplanned expenses, would have an impact totalling up to 2.6 billion euros ($2.8 billion) in the 2024 financial year.

It lowered its forecast for operating returns to 6.5-7% from 7-7.5%, prompting parent company Porsche SE (PSHG_p.DE), opens new tab, which owns just under a third of Volkswagen AG but holds most of the voting rights, to lower its earnings forecast to 3.5 billion to 5.5 billion euros.

Frankfurt-listed shares in Volkswagen and Porsche SE were down 1.7% and 2.1%, respectively, following the news.

Demand for Audi's Q8 e-tron, launched in 2018, had dropped sharply and the carmaker was considering ending its production altogether, with one source close to the company saying this could happen in 2025.

LONG-STANDING CHALLENGES

The Brussels site, which built around 50,000 cars last year, also faced "long-standing structural challenges" including difficulty in changing its layout due to proximity to the city and high logistics costs.

A consultation process would now begin to find alternative solutions for the plant, which employs around 3000 people. "This may include ceasing operations if no alternative is found," Audi's statement said.

Volkswagen's first quarter operating profits were down 20%, in part hampered by delivery delays at Audi, after the Brussels plant closed for two weeks because of component shortages in February.

A spokesperson said at the time that Audi was assessing options for what could be produced at the plant.

"The employee representatives of Audi AG are calling for a future-proof perspective for the plant and our colleagues in Brussels. The Audi management must take responsibility for the site," Rita Beck, spokeswoman for the Audi Committee in the European VW Group Works Council, said.

Other unplanned expenses weighing on the Volkswagen Group included exchange rate losses because of the deconsolidation of Volkswagen Bank Rus in its financial services division, and the planned closure of the gas turbine business of subsidiary MAN Energy Solutions.